A delegation from the Kenya Association of Waste Recyclers (KAWR), led by the Secretary General, Mr. Richard Kainika (seated second from the right), held a meeting with a team from the Kenya Revenue Authority (KRA), led by Ms. Hakamba Wangwe, Chief Manager – eTIMS (seated third from the right), at JKUAT Towers, Nairobi, on 22nd January 2026.

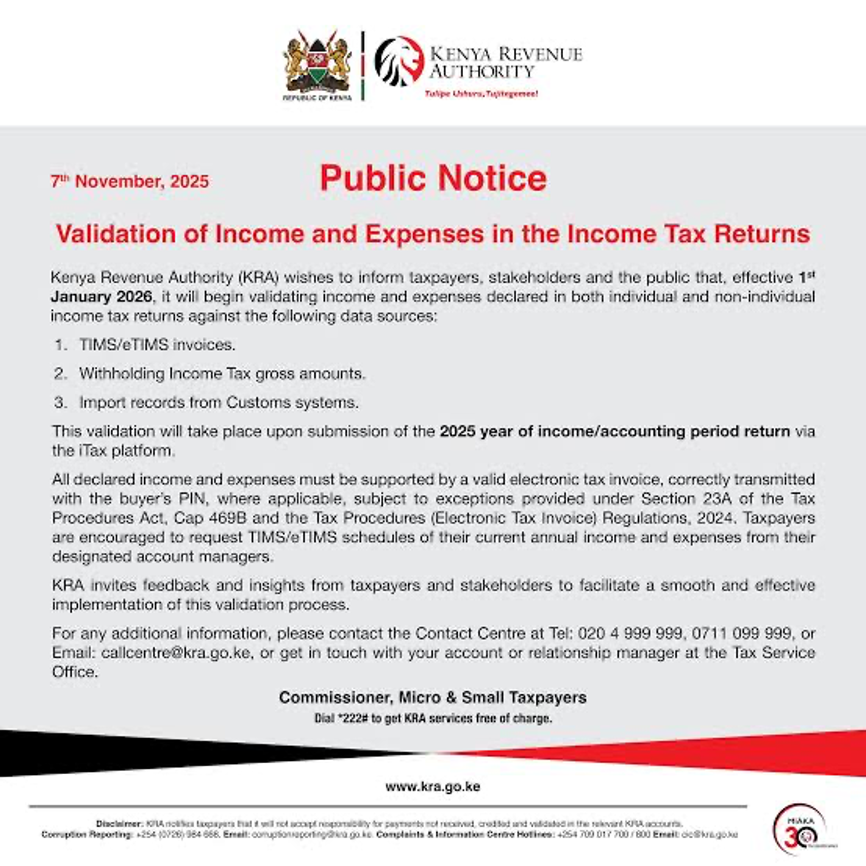

The Kenya Association of Waste Recyclers (KAWR) held a consultative meeting with the Kenya Revenue Authority (KRA) at the KRA boardroom, JKUAT Towers, Nairobi, to discuss the impact of the KRA Public Notice of 7 November 2025 on the validation of income and expenses within the waste management and recycling sector.

The KAWR delegation was led by Secretary General Richard Kainika, accompanied by regional representatives Nicodemous Aono (Nairobi), Samuel Matimu (Rift Valley), and Rachel Kibali (Western), alongside Muhammed Iqbal, Lilian Ngibeyo, Joshua Obuya, Sylvia Ochiba, and Jacob Ondara. Chief Manager Etims KRA, Ms. Wangwe Hakamba opened the meeting and welcomed the delegation.

KAWR presented its position on the Public Notice, noting that while it supports KRA’s tax compliance and digitalization agenda, including eTIMS, the recycling sector operates through a fragmented value chain. Primary collection is largely informal, aggregation is conducted by micro-enterprises, and processing is undertaken by formal entities, resulting in most recyclable materials being sourced from suppliers who are neither VAT-registered nor eTIMS-enabled.

KRA Public Notice of 7 November 2025

KAWR cautioned that strict enforcement would lead to disallowance of raw material expenses, the sector’s largest cost component, thereby inflating taxable profits despite actual losses. Additional risks identified included VAT imbalances due to the inability to claim input VAT, cashflow constraints, market distortion favoring informal operators, and adverse social and environmental impacts, including reduced collector incomes and increased dumping.

The Association highlighted sector characteristics such as high transaction volumes with low unit values, thousands of micro-suppliers, daily cash transactions, and thin margins, noting that non-compliance by a single supplier can invalidate documentation across the value chain.

KAWR proposed a transitional period allowing recognition of alternative documentation, including petty cash records, delivery notes, aggregator or CBO receipts, supplier registers, and mobile money statements. It further recommended phased enforcement focused on education, simplified registration and eTIMS models for small collectors and aggregators, and issuance of sector-specific guidance on expense validation.

During the discussions, members sought clarification on the distinction between Value Added Tax (VAT) and Turnover Tax (TOT). Turnover Tax applies to businesses whose gross turnover exceeds KES 1,000,000 but does not exceed, or is not expected to exceed, KES 25,000,000 in any year of income. TOT is charged under Section 12(C) of the Income Tax Act (Cap. 470) and is payable at the rate of 1.5 percent of gross sales. Value Added Tax, on the other hand, is an indirect tax borne by the final consumer and is levied on taxable goods and services supplied in Kenya and on taxable goods imported into Kenya.

As a result of the discussions, KRA agreed to allow recyclers to proceed with filing their returns in March, as sector-specific issues continue to be addressed. Recyclers were advised to assess both VAT and Turnover Tax regimes and adopt the option most favorable to their business operations, subject to statutory eligibility. KRA acknowledged and appreciated the concerns raised by recyclers and committed to providing ongoing support to KAWR members to facilitate compliance with applicable tax requirements.

KRA advised KAWR to convene member sensitization forums with KRA participation and noted the importance of engaging associations during policy formulation.